Avoiding Change Fatigue

Explore practical solutions that combat change fatigue from seasoned executives, with strategies ranging from active listening to fostering organizational resilience throughout large, international corporations.

Explore practical solutions that combat change fatigue from seasoned executives, with strategies ranging from active listening to fostering organizational resilience throughout large, international corporations.

Navigate organizational change effectively and mitigate sources of resistance to change by deploying proven tactics like proactive talent retention, honest communication, and leadership coaching around change.

Explore the roadmap to cultural change with key insights from senior executives in change leadership! Discover how transparent communication, active employee engagement, and celebrating success can drive organizational resilience.

Hone your ability to easily and fluidly adapt your communication style as well as your approach to effectively engage diverse audience segments, fostering meaningful dialogue and collaboration towards shared goals.

Learn how senior change leaders secure C-suite buy-in, educating important stakeholders and driving transformation within their organization. From influencing allies to addressing concerns, delve into practical tactics that lead to successful, large-scale change initiatives.

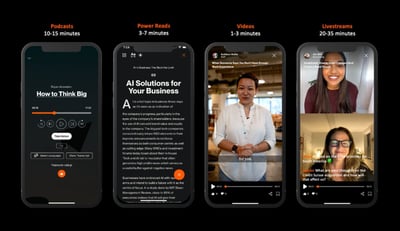

Professional Coach, powered by OpenAI's ChatGPT and Tigerhall, learned from over 1,500 global business leaders from companies like Meta, IBM, J.P. Morgan, and Verizon, offering 10,000 actionable insights to individuals and professionals

The landscape of corporate learning is rapidly evolving, and companies searching for solutions. Explore how to introduce new learning methods, the significance of communication and change management, and the key insights gleaned from adopting an innovative platform like Tigerhall.